Start Exness Trading: A Comprehensive Guide

Trading in the forex market has become increasingly popular in recent years, and platforms like Exness have made it more accessible than ever. If you are looking to start Exness trading and embark on your journey in the world of forex, this guide will provide you with all the essential information needed to get started. Whether you’re a complete beginner or an experienced trader looking for a new platform, understanding the key aspects of trading with Exness is crucial. For more insights, feel free to check out Start Exness Trading http://topschool-pnf.pl/?p=234027.

What is Exness?

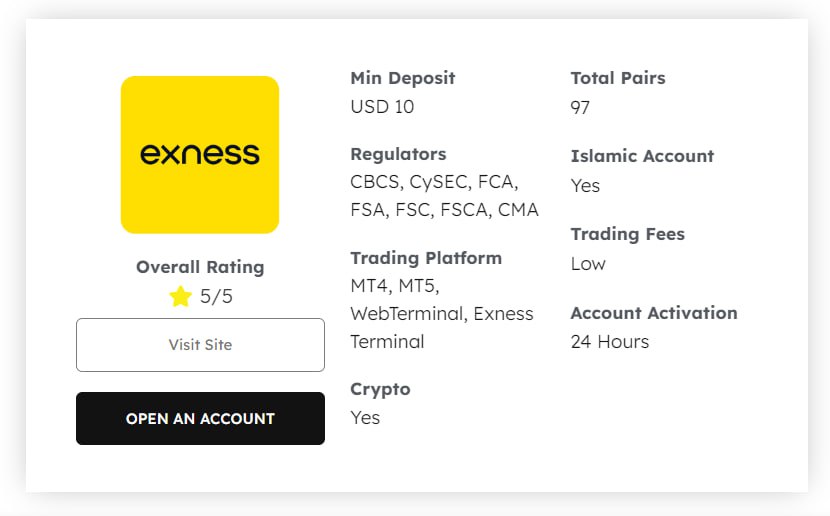

Exness is a global forex and CFD broker that offers a user-friendly platform for trading various financial instruments, including currency pairs, commodities, stocks, and indices. Founded in 2008, the company has earned a solid reputation in the trading community for its reliable execution, transparent operations, and extensive educational resources. Exness is regulated by multiple authorities, providing traders with a sense of security and trust.

Getting Started with Exness Trading

The process of starting to trade with Exness is straightforward. Here are the steps you need to follow:

- Sign Up for an Account: Visit the Exness website and register for a trading account. Make sure to provide accurate personal information and complete the verification process.

- Choose Your Account Type: Exness offers various account types, including Standard accounts for beginners and Pro accounts for more experienced traders. Choose the one that best fits your trading style.

- Fund Your Account: Once your account is set up, deposit funds into your Exness trading account. Exness supports multiple payment methods, including bank transfers, credit/debit cards, and e-wallets.

- Download Trading Software: Exness provides access to popular trading platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Download and install the platform of your choice to begin trading.

- Learn and Practice: Before risking your funds, take advantage of Exness’s educational resources and consider using the demo account feature to practice your trading strategies without any financial risk.

Understanding Forex Trading Basics

Before diving into the specifics of Exness trading, it’s essential to understand some fundamental concepts of forex trading. The forex market is the largest and most liquid market in the world, where currencies are traded in pairs (e.g., EUR/USD, GBP/JPY). Here are some key terms and concepts you should be familiar with:

- Currency Pairs: Currencies are traded in pairs, where one currency is quoted against another. The first currency is the base currency, and the second is the quote currency.

- Pips: A pip is the smallest price move that a given exchange rate can make based on market convention. Most pairs are quoted to four decimal places; for example, if EUR/USD moves from 1.1000 to 1.1001, that is a movement of one pip.

- Leverage: Exness offers various leverage options, allowing traders to control larger positions with a smaller amount of capital. While leverage can amplify profits, it can also increase potential losses, so it should be used with caution.

- Spread: The spread is the difference between the bid and ask price of a currency pair. Understanding spreads is crucial for calculating potential trading costs.

Developing a Trading Strategy

Having a well-defined trading strategy is vital for success in the forex market. Here are some popular trading strategies you might consider:

- Day Trading: This strategy involves opening and closing trades within a single day. Day traders aim to profit from short-term price movements and often rely on technical analysis.

- Swing Trading: Swing traders hold positions for several days or weeks in hopes of capturing larger price shifts. This approach requires a good understanding of market trends and technical indicators.

- Scalping: Scalpers make numerous trades throughout the day to capture small price movements. This strategy requires quick decision-making and a solid grasp of market dynamics.

Risk Management in Trading

Effective risk management is crucial for preserving your trading capital and ensuring long-term success. Here are a few principles to consider:

- Set Stop-Loss Orders: Always use stop-loss orders to limit potential losses. A stop-loss order automatically closes your position when it reaches a specified price level.

- Don’t Risk More Than You Can Afford to Lose: Only invest amounts that you can afford to lose without affecting your financial stability.

- Diversify Your Portfolio: Avoid putting all your capital into one trade or currency pair. Diversification can help mitigate risk.

Utilizing Exness’ Educational Resources

One of the standout features of Exness is its commitment to educating traders. The platform offers a range of resources, including webinars, video tutorials, articles, and market analysis. Take advantage of these resources to improve your trading skills and stay updated with market trends.

Conclusion

Starting your trading journey with Exness can be a rewarding experience if approached with the right knowledge and strategies. By understanding the fundamentals of forex trading, developing a solid trading plan, and practicing good risk management, you can enhance your chances of success in the forex market. Remember that trading requires patience and discipline, so take your time to learn and grow as a trader. Happy trading!