Some liabilities are considered off the balance sheet, meaning they do not appear on the balance sheet. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. A company should make estimates and reflect their best guess as a part of the balance sheet if they do not know which receivables a company is likely actually to receive. For instance, accounts receivable should be continually assessed for impairment and adjusted to reveal potential uncollectible accounts.

Do you own a business?

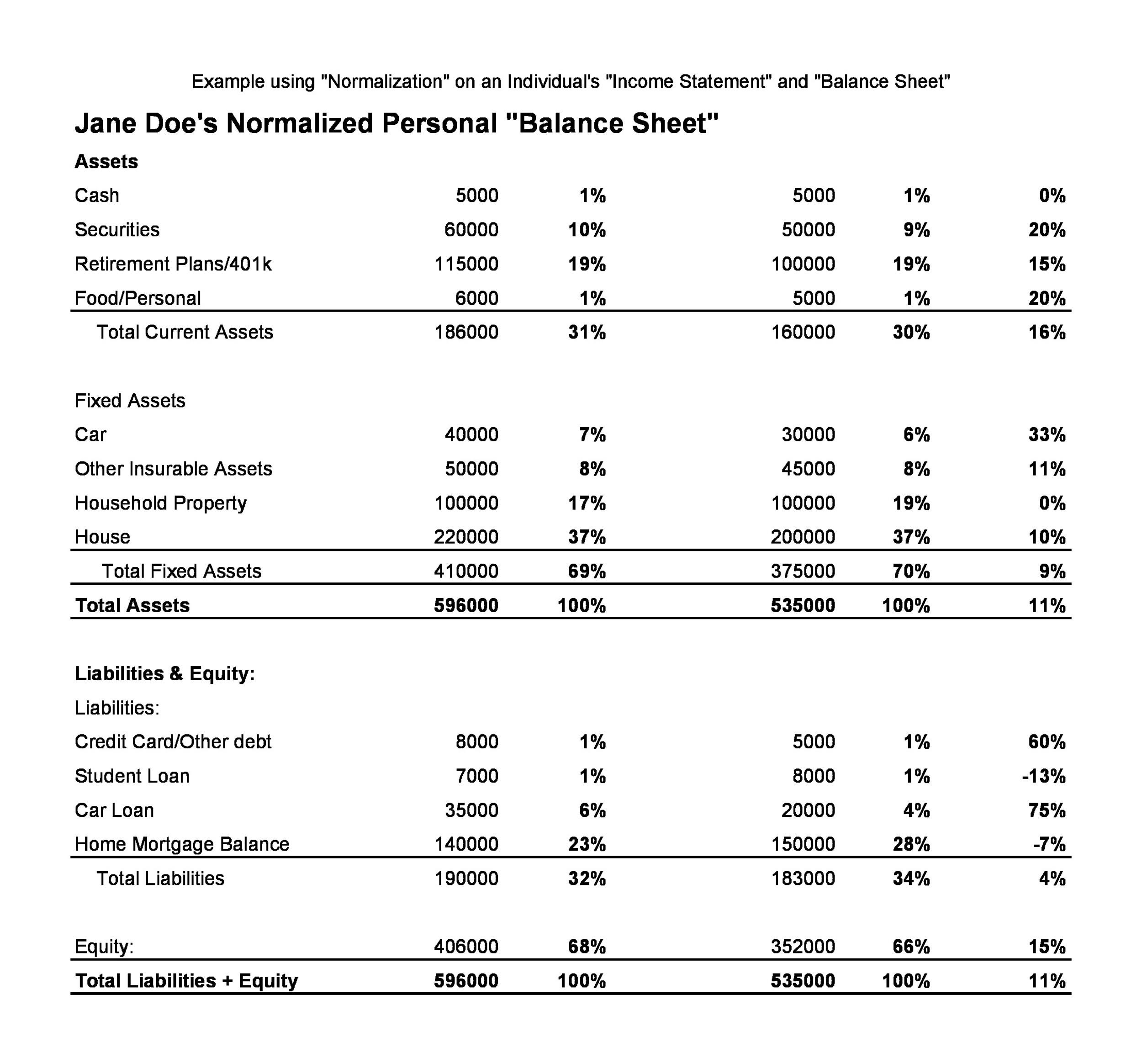

Finally, unless he improves his debt-to-equity ratio, Bill’s brother Garth is the only person who will ever invest in his business. The situation could be improved considerably if Bill reduced his $13,000 owner’s draw. Unfortunately, he’s addicted to collecting extremely rare 18th century guides to bookkeeping. Until he can get his bibliophilia under control, his equity will continue to suffer. Bill’s quick ratio is pretty dire—he’s well short of paying off his liabilities with cash and cash equivalents, leaving him in a bind if he needs to take care of that debt ASAP.

QuickBooks Support

He doesn’t have a lot of liabilities compared to his assets, and all of them are short-term liabilities. It’s important to note that the balance sheet should always balance. However, there are instances where it might not because a mistake has been made in the process.

The debt-to-equity ratio

Investors and creditors generally look at the statement of financial position for insight as to how efficiently a company can use its resources and how effectively it can finance them. The balance sheet is one of the three main financial statements, along with the income statement and cash flow statement. Navigating the financial landscape of small businesses requires a solid understanding of balance sheets.

- If he can sell them off to another bookseller as a lot, maybe he can raise the $10,000 cash to become more financially stable.

- For an easy-to-use online balance sheet template, see this basic balance sheet template.

- Some candidates may qualify for scholarships or financial aid, which will be credited against the Program Fee once eligibility is determined.

Long-term assets or non-current assets are assets not expected to take more than one year to be consumed or converted into cash. Long-term assets often how is computer software classified as an asset include items like real estate or machinery. It is also convenient to compare the current assets with the current liabilities.

Balance Sheet Terms Explained

If they don’t balance, there may be some problems, including incorrect or misplaced data, inventory or exchange rate errors, or miscalculations. According to the historical cost principle, all assets, with the exception of some intangible assets, are reported on the balance sheet at their purchase price. In other words, they are listed on the report for the same amount of money the company paid for them. This typically creates a discrepancy between what is listed on the report and the true fair market value of the resources. For instance, a building that was purchased in 1975 for $20,000 could be worth $1,000,000 today, but it will only be listed for $20,000.

Investors, creditors, and internal management use the balance sheet to evaluate how the company is growing, financing its operations, and distributing to its owners. It will also show the if the company is funding its operations with profits or debt. Unlike the asset and liability sections, the equity section changes depending on the type of entity.

Even better, QuickBooks Online gets you access to QuickBooks Live Expert Assisted, which can include having experts send your balance sheet to you. Whether you need some coaching or to offload some bookkeeping work, QuickBooks’ trusted experts can work however you want to work. Try spending more time in your business and less time on your books and reporting with QuickBooks Live Bookkeeping. The statement of financial position or (SOFP) is just another name for the balance sheet.

Current assets consist of resources that will be used in the current year, while long-term assets are resources lasting longer than one year. It is also helpful to pay attention to the footnotes in the balance sheets to check what accounting systems are being used and to look out for red flags. For instance, if someone invests $200,000 to help you start a company, you would count that $200,000 in your balance sheet as your cash assets and as part of your share capital. Shareholder’s equity is the net worth of the company and reflects the amount of money left over if all liabilities are paid, and all assets are sold. In order to see the direction of a company, you will need to look at balance sheets over a time period of months or years.

This is why the balance sheet is sometimes considered less reliable or less telling of a company’s current financial performance than a profit and loss statement. Annual income statements look at performance over the course of 12 months, where as, the statement of financial position only focuses on the financial position of one day. The balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the accounting cycle. It reports a company’s assets, liabilities, and equity at a single moment in time. You can think of it like a snapshot of what the business looked like on that day in time.

The reason for this equation is that if you take the total assets of the business and then subtract the total liabilities, you are left with the amount that belongs to the business owners. The reason for dividing current and long-term assets is that these categories can be used to measure the liquidity of a company by turning assets into cash. Plus, when your balance sheets are paired with your accounting software it allows you to have a complete picture of the health of your company. When the balance sheet is prepared, the liabilities section is presented first and the owners’ equity section is presented later. The information found in a company’s balance sheet is among some of the most important for a business leader, regulator, or potential investor to understand.